Corporate Governance

The Group pursues transparent and fair management through effective corporate governance, to increase its corporate value.

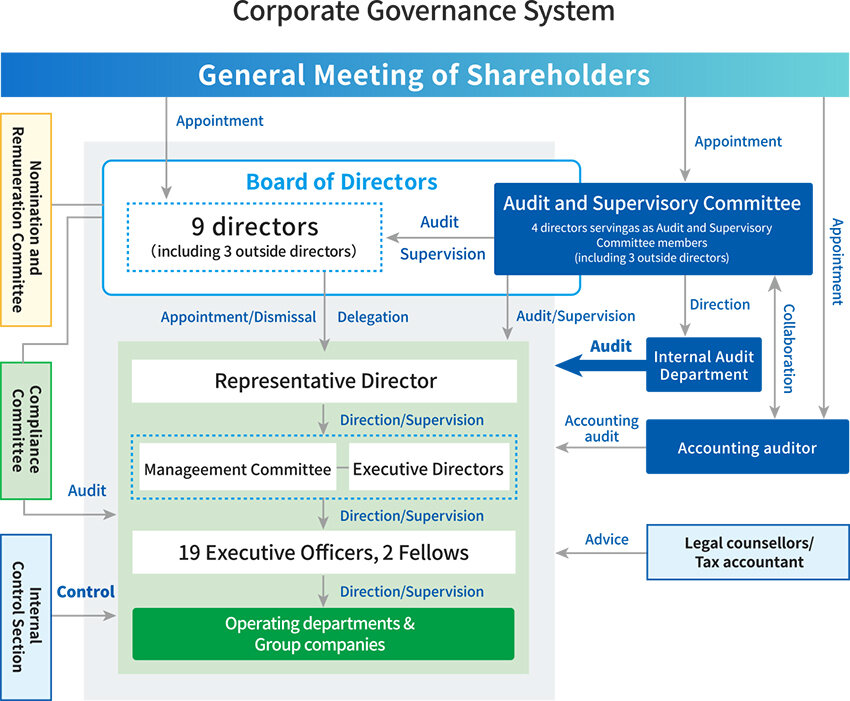

Corporate Governance System

Basic Approach

Based on the corporate philosophy of "Through the endless possibilities of chemistry, we bring happiness created by highly functional materials," the Group strives to fulfill its corporate social responsibility by positioning the enhancement of corporate governance as a key priority for management. The Group pursues transparent, fair, swift and resolute decision-making through effective corporate governance, to achieve sustainable growth and to increase its corporate value over the medium and long term. The Group is committed to the continuous enhancement of corporate governance.

The Group's basic approach to corporate governance is as follows.

- Respect shareholders' rights and ensure their equality.

- Consider the interests of various stakeholders, including shareholders, customers, suppliers, employees and local communities. Build good relationships with these stakeholders and properly cooperate with them.

- Disclose corporate information appropriately and ensure transparency.

- Strive to ensure effective supervisory functions for business execution by the Board of Directors.

- Engage in constructive dialogue with shareholders who have an investment policy that aligns with medium- to long-term shareholder profits.

Corporate Governance System

Toagosei is a company with an audit & supervisory committee. Audit & Supervisory Committee members, including several independent outside directors, have voting rights on the Board of Directors so that audit and supervision over business execution have been strengthened. Furthermore, the Articles of Incorporation provide that important decision-making for management may be delegated in whole or in part to directors. Thus, a system is in place that separates supervision and business execution and enables swift decision-making with regard to business execution.

Internal Control

The Company has established the Basic Policy on Internal Control by resolution of the Board of Directors to ensure the appropriateness of operations. In accordance with the said policy, the Internal Control Section confirms the operating status of internal control from an independent perspective, reports such results to the Board of Directors and Audit & Supervisory Committee members, and performs duties related to internal control (duties to ensure appropriate financial reporting), based on Japan's internal control reporting system (J-SOX). The Internal Audit Department conducts internal audits on the status of compliance and appropriateness of business operations within the Group under the supervision of the Audit & Supervisory Committee. The Internal Control Section and Internal Audit Department, in cooperation with each other, ensure that the Group's business operations as a whole are conducted appropriately in compliance with relevant laws and regulations.

Information Disclosure

Relations with Shareholders and Investors

Our view on information disclosure

We disclose information based on the disclosure policy we have established.

Disclosure Policy

- Basic Policy on Information Disclosure

Toagosei Co., Ltd. (below, "the Company") will strive to disclose information to stakeholders including shareholders, customers, suppliers, employees and local communities in a timely, appropriate and fair manner pursuant to the Toagosei Group Basic Policy on Corporate Governance in an effort to obtain their correct understanding of the Group. - Standards of Information Disclosure

The Company will disclose not only financial information of the Group, such as financial condition and management results, but also non-financial information on such topics as management strategy, risks and corporate governance in a timely, appropriate and fair manner pursuant to laws such as the Financial Instruments and Exchange Act and Companies Act and the rules set forth by the Tokyo Stock Exchange. In addition, the Company will actively disclose other information not set forth in laws and rules determined to be useful or beneficial for stakeholders to establish a correct understanding of the Group. - Information Disclosure System

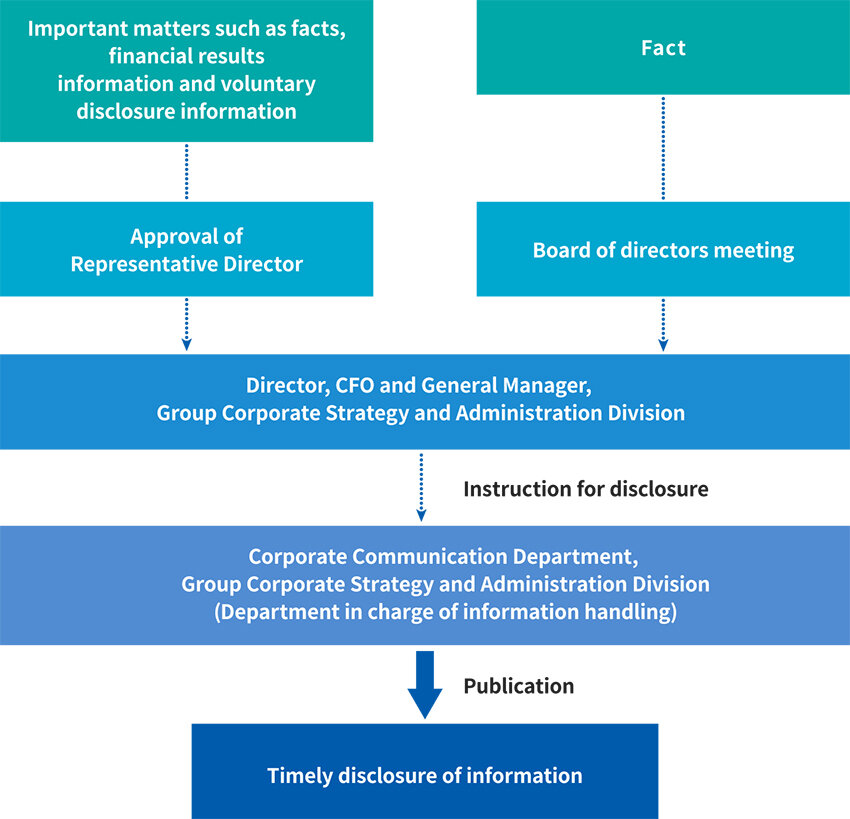

We have established the IR Committee, chaired by the director in charge of information disclosure (General Manager of the Group Administrative Division). Committee members determine important information and prevent the leakage of insider information by reporting information concerning timely disclosures from the business departments they are responsible for to the committee. After approval is obtained without delay from the appropriate decision-making body and Representative Directors regarding important matters such as facts, financial results information and voluntary disclosure information, the General Manager of the Group Administrative Division instructs the Corporate Communication Department under the Group Administrative Division to disclose information. In turn, the department disseminates information as the department in charge of information handling and serves as the contact point for inquiries from stakeholders.

Internal System for Timely Disclosure of Company Information

- Methods of Information Disclosure

The Company discloses information through the electronic disclosure system (EDINET) for disclosure documents such as securities reports provided by the Financial Services Agency and the timely disclosure network (TDnet) of Tokyo Stock Exchange. The Company also posts information to its website immediately after disclosure. In addition, the Company actively posts to its website information on the Group determined to be useful or beneficial to stakeholders. - Quiet Period

The Company observes a quiet period from the day after the fiscal year end, including quarterly financial results, to the financial results announcement date in order to prevent leakages of financial results information including quarter financial results and secure the fairness of information disclosures. During this period, the Company does not disclose information concerning financial results or earnings forecasts. However, if significant revisions to the earnings forecast are anticipated during the quiet period, the Company will disclose these following the rules for timely disclosure. Furthermore, the Company will respond to inquiries concerning information on the Group that is already public knowledge, even during the quiet period. - Disclosure of Information to Third Parties and Earnings Forecast by Third Parties

During individual meetings with institutional investors and analysts, the Company will only discuss facts that have already been published, commonly known facts, and general information on the business climate. The Company does not endorse any comments or earnings forecasts by third parties.

General meeting of shareholders

We aim to conduct general meetings of shareholders that are easy to participate and understand for all shareholders by sending out notices of convocation early and making visual presentations. Moreover, we are working to improve the convenience for all shareholders with introduction of online voting, and participation in electronic voting platform for institutional investors, and disclosure of convocation notice in English, etc. The convocation notice, resolution notice and voting results are also published on the company website, making them accessible to all investors other than shareholders.